Truss Financial

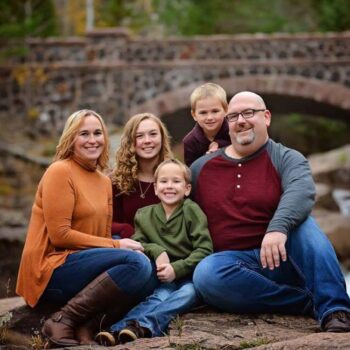

-Jason Kuss-

About

Jason started in the financial industry with Waddell & Reed in late 2009. Prior to being a financial advisor, Jason was a television news sportscaster in the Duluth area until he was let go in 2007. Being from the Iron Range of MN originally, he didn’t want to chase the television dream across the country, so he chose to stay in the area. After losing his dream job, and almost losing everything else because of it, his attention turned to adjusting his financial ways. This eye-opening experience, though quite difficult, created a new passion for Jason, and lead him in search of a new career where he could utilize that passion to help others. Residing in Cloquet, MN, with his wife and two sons, Jason leads a busy life on the water, at the ball field, gym and gridiron. When not feeding his love of sports through his kids activities, you’ll find him to be an avid Vikings, Wild and UMD Bulldogs fan. Jason is proud to bring his passion, experience, and knowledge to his clients who are looking to pursue their financial goals. Whether it’s becoming debt free, planning for retirement, leaving a legacy to those you’ll leave behind, and so on… his over 10 years of experience continues to see him strive to go the extra mile for our clients. “I love it when we are the first call clients make when making a financial decision. Our role is to help, and we appreciate the opportunities our clients give us to do so.”

Where will your retirement money come from? If you’re like most people, qualified-retirement plans, Social Security, personal savings and investments are expected to play a role. Once you have estimated the amount of money you may need for retirement, a sound approach involves taking a close look at your potential retirement-income sources.

Effective estate management enables you to manage your affairs during your lifetime and control the distribution of your wealth after death. An effective estate strategy can spell out your healthcare wishes and ensure that they’re carried out – even if you are unable to communicate. It can even designate someone to manage your financial affairs should you be unable to do so.

Investing should be easy – just buy low and sell high – but most of us have trouble following that simple advice. There are principles and strategies that may enable you to put together an investment portfolio that reflects your risk tolerance, time horizon, and goals. Understanding these principles and strategies can help you avoid some of the pitfalls that snare some investors.

Insurance transfers the financial risk of life’s events to an insurance company. A sound insurance strategy can help protect your family from the financial consequences of those events. A strategy can include personal insurance, liability insurance, and life insurance.

Understanding tax strategies and managing your tax bill should be part of any sound financial approach. Some taxes can be deferred, and others can be managed through tax-efficient investing. With careful and consistent preparation, you may be able to manage the impact of taxes on your financial efforts.

One of the keys to a sound financial strategy is spending less than you take in, and then finding a way to put your excess to work. A money management approach involves creating budgets to understand and make decisions about where your money is going. It also involves knowing where you may be able to put your excess cash to work.

Creating a life map involves a close review of personal finances and an assessment of other building blocks. Lifestyle matters look at how to balance work and leisure, how to make smart choices for the future, and many other items in an effort to help an individual “enjoy the journey.”