Gloria Allan

NMLS#397714

"Positively Unique"

About

I am a Branch Manager in the mortgage industry, with years of experience and expertise in helping individuals and families achieve their dreams of owning a home. Guiding people through the complexities of the mortgage process and witnessing the joy of new homeowners is a deeply rewarding part of my professional journey.

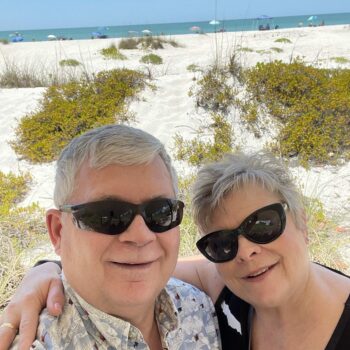

However, my role as a Branch Manager is just one aspect of my identity. I am also a devoted mom and wife, cherishing every moment with my family and finding joy in the little things that make life special. Balancing the demands of a career with the joys of motherhood and being a supportive partner is an ongoing adventure that has taught me invaluable lessons in time management, resilience, and the true meaning of love.

But my commitment to making a positive impact extends beyond the walls of my home and office. As a firm believer in community power, I actively volunteer in various local initiatives and charitable causes. Whether it’s participating in local events, supporting education and youth development, or promoting initiatives to protect our environment, I am deeply invested in making our community a better place for everyone.

Home Buyers and homeowners are renovating like never before, with a renovation loan they have funds for a wide range of projects, from required repairs, energy updates, landscaping and even an addition. A renovation loan can make the difference between making a house a dream home, or helping restore an older home to its former glory.

Now you can give your customers the option to renovate and rehab a new or existing home by including financing in their conventional purchase or refinanced home loan. The loan to value is calculated by taking the proposed project into account, using the as completed value giving them more purchasing power and more options to make their home their own.

A Reverse Mortgage or Home Equity Conversion Mortgage is an increasingly popular consumer loan for senior homeowners age 62+ that are looking to remain in their home. It allows these homeowners to tap into the home equity that has been built up. There are no monthly mortgage payments and homeowners can generally receive their home equity as tax-free cash. The repayment of the loan is deferred until the homeowner sells, moves out of the home for more than 12 consecutive months or passes away.

A home equity loan allows you to borrow against your home equity, which is the portion of your home that you own. These loans are sometimes called second mortgages, equity loans, equity line of credit or home equity installment loans. They provide you with a lump sum of money that you can spend however you want. In return, you’ll make monthly payments, typically with fixed interest rates, though some prefer the variable interest rate options!

A construction mortgage is a short-term loan product that covers the cost of building a home. There are two main types of construction mortgages. Stand-alone requires two separate loan closings. Construction-to-permanent, which starts out as a construction loan and converts to a regular mortgage upon building completion, requires only one closing.